modified business tax return instructions

The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. Most requests will be.

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

To get started on the blank use the Fill camp.

. Learn more Form 4506-T Request for Transcript of Tax Return. File the 2021 return for calendar year 2021 and fiscal years that begin in 2021 and end in 2022. The rental property was mainly used in the trade or business activity during the tax year or during at least 2 of the 5.

Individual Tax Return Form 1040 Instructions. Individual Tax Return Form 1040 Instructions. You can use this form for forms 1120 1120-C 1120-F 1120-L and 1120-PC.

Instructions for Form 1040. 1067 and as modified by Rev. This is the standard.

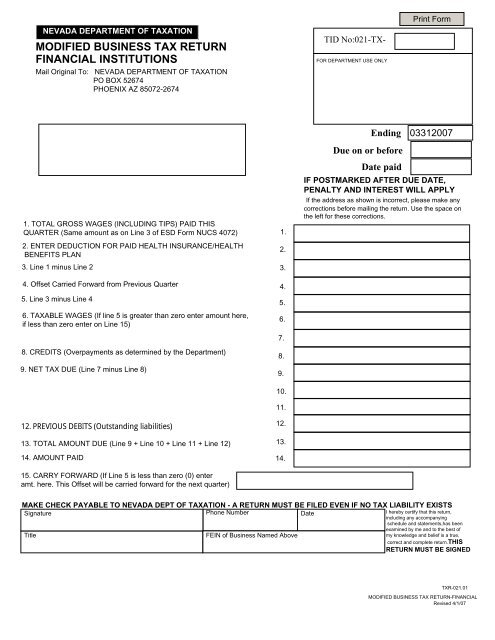

Enter the amount from line 3 here and on Form 4562 line 1. The maximum section 179 deduction limitation for 2021. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU.

IT-565i 121 Instructions for Partnership Return of Income Tax Year 2020 Column 6 - If the partner is an individual or individuals nominee enter a Y if the individual partner was a. The Nevada Modified Business Return is an easy form to complete. Attach Form 8960 to your return if your.

Modified Business Tax Return-General Businesses 7-1-16 to Current. The Nevada Modified Business Return is an easy form to complete. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU.

Gross wages payments made and individual employee. It requires data and information you should have on-hand. 419 as clarified and modified by Rev.

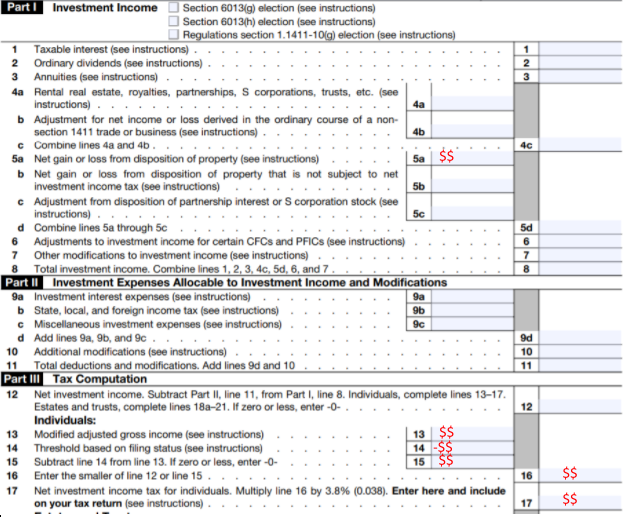

Your modified adjusted gross income see the instructions for line 6. POPULAR FORMS. When and Where to File Form 3115.

Sign Online button or tick the preview image of the blank. Total gross wages are the total amount of all gross wages and. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the businessTax is based.

For a fiscal or short tax year return fill in the tax year space at the top of the form. To amend a tax return for an S corporation file an amended Form 1120-S and check Box H 4. Enter the smaller of line 1 or line 2 here.

Instructions for Form 1040 Form W-9. How you can complete the Nevada modified business tax return form on the web. The documents found below are available in at least one of three different.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

Modified Business Tax Return Financial Institutions

Irs Form 4562 Explained A Step By Step Guide

Modified Business Tax Return Financial Institutions

What Is Form 1120s And How Do I File It Ask Gusto

Don T Leave Money On The Table Employee Retention Credit Modified And Extended

Nevada Modified Business Tax Form 2020 Fill And Sign Printable Template Online Us Legal Forms

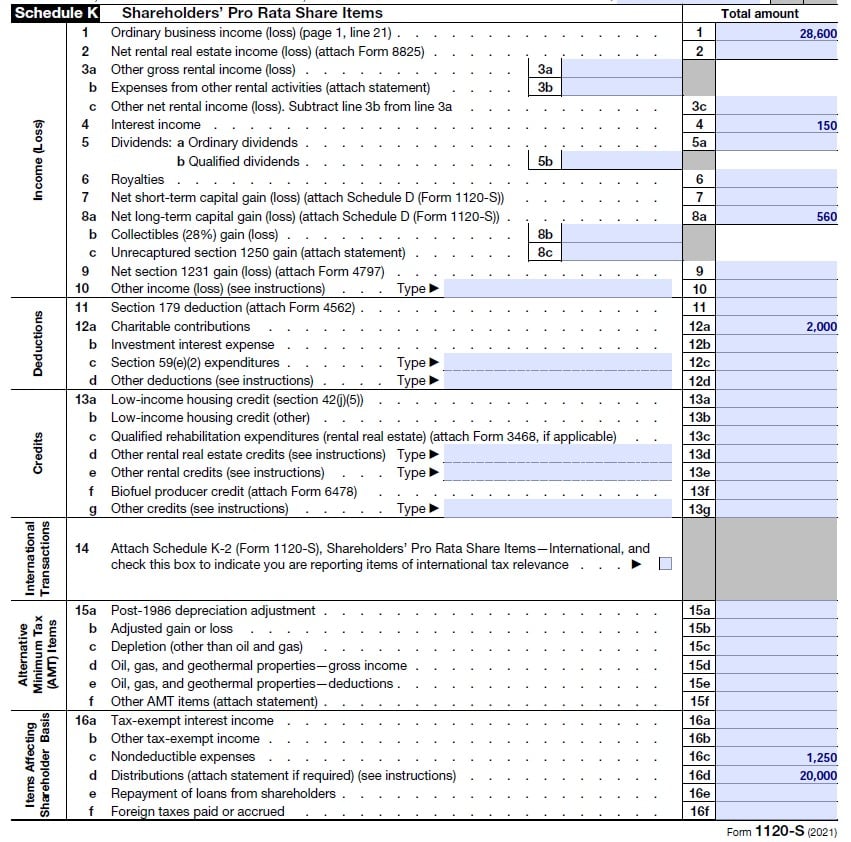

How To Complete Form 1120s Schedule K 1 With Sample

Modified Business Tax Return Financial Institutions

Detailed Irs Tax Filing Instructions For Section 1202 Qsbs Expert

How To Complete Form 1120s Schedule K 1 With Sample

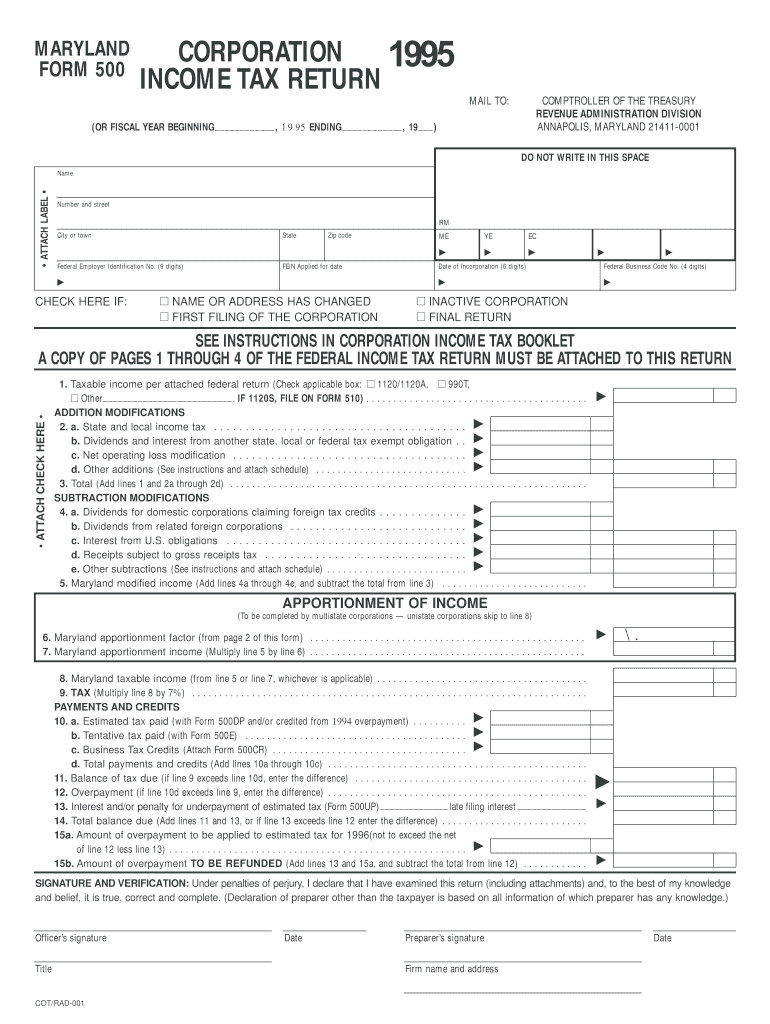

Maryland Form 500 Fill Out And Sign Printable Pdf Template Signnow

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Making Taxes Easy Tips For Organizing Receipts And Expenses Turbotax Tax Tips Videos

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

1040 2021 Internal Revenue Service

Ghj Income Tax Reporting For The Employee Retention Credit

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Modified Business Tax Form Fill Out Printable Pdf Forms Online